How Are U.S. Tariffs Forging a New Global Aluminum Extrusion Landscape in 2025?

The recent rise in U.S. aluminum tariffs is shaking up the global aluminum extrusion market. This change affects supply chains, costs, and recycling efforts.

This article explains these shifts clearly. We explore how supply chains move, how prices respond, and how companies adjust. Whether you work in manufacturing, follow trade trends, or just want to understand the market, this article offers clear insights.

The aluminum industry in 2025 looks very different from before. Get ready for a fresh look at a changing landscape.

Key Insights into the Evolving Aluminum Market

- In June 2025, the U.S. raised Section 232 tariffs on aluminum imports to 50%.

- This increase pushed prices higher and forced companies worldwide to change their supply chains.

- The higher tariffs boosted aluminum production in the U.S. Domestic plants are stepping up.

- Scrap aluminum avoids these tariffs. Recycling has grown as a cheaper and greener choice.

- The tariffs changed global trade flows, making exporters rethink their strategies.

- Some countries consider retaliating with their own tariffs, raising trade tensions.

The aluminum extrusion market plays a vital role. It supplies materials for cars, aircraft, buildings, and electronics. In 2025, this market is in a state of change. Aluminum profiles manufacturers, suppliers, and customers worldwide feel the pressure.

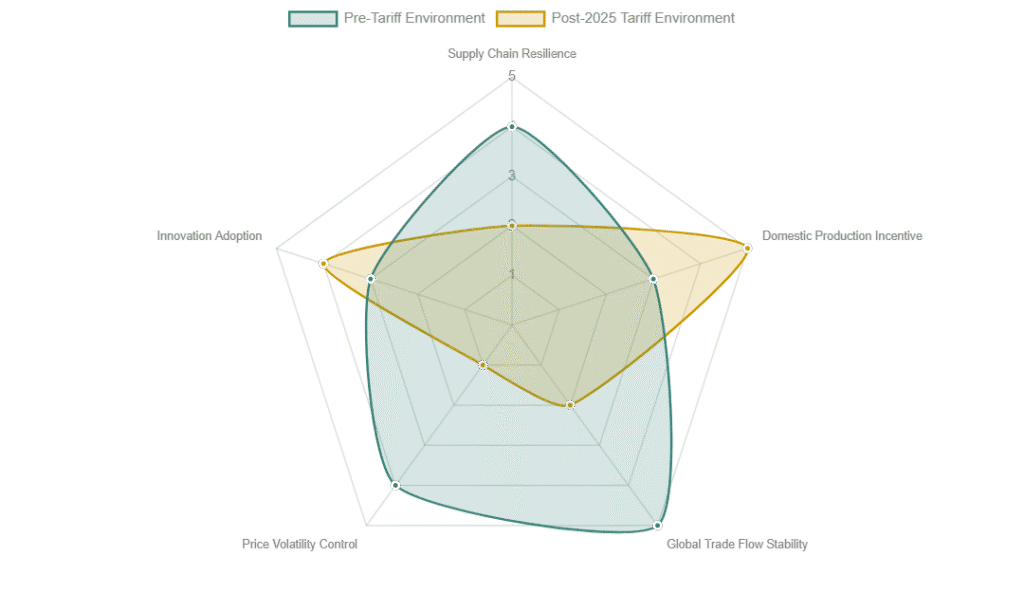

The radar chart compares the global aluminum extrusion market before and after the 2025 U.S. tariff changes. It shows changes in key areas: supply chain strength, domestic production incentives, global trade flow stability, price volatility control, and innovation speed. After 2025, the market shows lower stability and less price control. However, incentives for domestic production and innovation have risen. These shifts reflect how the market adjusts to new economic conditions.

The Genesis of Change: U.S. Tariffs in 2025

In 2018, the U.S. set a 25% tariff on imported aluminum under Section 232, citing national security concerns. Then, in June 2025, the government doubled this tariff to 50%. This increase hit the market hard and changed the rules.

Most countries faced the full 50% tariff. The United Kingdom kept the 25% rate due to special trade agreements. Other trade tools, like tariff rate quotas and drawback allowances, were removed. This made it harder for companies to reduce costs.

The higher tariffs also applied to aluminum products derived from raw aluminum. This shift complicated import rules and made compliance more difficult. Businesses now face stricter regulations and fewer options to avoid costs.

The 2025 tariff changes are tougher and cover more ground. Companies must adjust quickly to these sharper rules and higher costs. The stakes are higher, and the market feels it.

A Historical Perspective on Section 232 Tariffs

The Section 232 tariffs come from the Trade Expansion Act of 1962. This law allows the President to limit imports if they threaten national security. In 2025, the U.S. raised aluminum tariffs from 25% to 50%. The government said it wants to strengthen domestic industries and increase steel and aluminum production.

The goal is to protect American producers facing tough global competition and a surplus of supply. Think of it as giving U.S. factories a fair shot in a crowded market. Raising the tariff to 50% shows a stronger push to support local businesses.

This change means less flexibility in the international aluminum trade. The U.S. puts its industry first, and foreign suppliers will feel the impact. Companies need to adjust quickly or risk losing ground.

The Specifics of the 2025 Tariff Hike

The U.S. raised tariffs on aluminum imports from 25% to 50%. This increase affects almost every country that exports aluminum to the U.S.

A small number of countries, like the UK, kept the lower 25% rate due to special trade agreements. These exceptions are rare.

The government removed previous tools like tariff rate quotas and drawback allowances. These changes close off options companies used to reduce costs.

The tariffs now include products made from aluminum, not just the raw metal. This broadens the rules and makes imports more complex.

Importers face stricter regulations and fewer ways to avoid tariffs. The aluminum trade is tougher and faster-moving than before.

Immediate Repercussions: Price Volatility and Supply Chain Upheaval

The U.S. doubled tariffs on aluminum. Prices jumped quickly. Imported aluminum grew more expensive. Domestic producers raised prices too. This increase pushed up costs across the supply chain.

Price changes now feel unpredictable. Companies rethink where they get aluminum. Profit margins shrink. Manufacturers and related industries face pressure.

Look at the Midwest Transaction Price and Midwest Premium. Both rose sharply. They show how imports cost more, and cheap foreign aluminum became scarce.

Ultimately, tariffs shook the market hard. Prices soared. Supply chains twisted. Everyone must adapt fast. The stakes got higher, and the ride got rougher.

Shifting Global Trade Flows

The new tariffs changed the global aluminum extrusion trade. Countries that once exported large amounts to the U.S. face higher costs and limited access. Buyers now look for alternatives. They turn to local producers or suppliers from countries outside the tariff zone.

This shift drives companies to diversify suppliers. They avoid relying on just one source. Some foreign suppliers invest in new factories outside the U.S. Others seek ways to avoid tariffs. These actions make global trade more complex.

The aluminum trade landscape is changing fast. Businesses must adapt or risk falling behind. It’s like a game of musical chairs with faster music and new rules.

The Unintended “Green Recycling Boom”

The U.S. set high tariffs: 50% on primary aluminum but almost no tariff on scrap metal. This difference made scrap aluminum more valuable. Recycling scrap became a smart, cost-saving choice.

More scrap aluminum now comes to the U.S. Investors build recycling plants to meet demand. Recycling aluminum uses only about 5% of the energy needed to make new aluminum.

This shift cuts costs and lowers environmental impact. It shows how policy changes can push markets to cleaner, cheaper methods. In a twist, trash turned into treasure.

Regional Market Performance and Strategic Adaptations

The tariffs have changed aluminum extrusion markets around the world. Companies like Hindalco Industries, Norsk Hydro ASA, Arconic Corp., and China Hugh Aluminum are adjusting their strategies to stay competitive.

North America: Growing Local Production

In North America, the tariffs pushed manufacturers to increase local production. U.S. firms invest in new extrusion and recycling plants. These steps help reduce the impact of imports and strengthen supply chains. Still, capacity remains below ideal levels. Supply delays and higher raw material costs limit growth. Sectors like automotive and construction face higher aluminum extrusion costs. They may raise product prices or seek other materials.

Asia-Pacific: Shifting Export Strategies

Asia-Pacific countries, led by China, India, and South Korea, remain top producers and consumers of aluminum extrusions. But U.S. tariffs force them to change export plans. Manufacturers look beyond U.S. markets. They develop new trade partners and deepen regional cooperation. This helps protect their market shares.

Europe: Preparing Retaliation

Europe watches the U.S. tariffs closely. The EU started discussions on possible counter-tariffs. These actions could trigger a wider trade conflict. Such disputes would affect economic growth, jobs, and prices across many countries. Europe is ready for a trade battle that will have consequences.

The bar chart shows key changes in the aluminum extrusion market before and after the 2025 tariffs. It highlights sharp rises in the cost of imported aluminum and domestic production. Lead times in supply chains have also grown longer. Market price volatility has increased. At the same time, investment in innovation has edged upward as companies adjust to these new costs. This chart captures the wide economic shifts caused by the tariff policies and how the market adapts under pressure.

Strategies for Market Adaptation

Tariffs disrupted the aluminum extrusion market. Companies act fast to manage rising costs and supply challenges. They use smart strategies to stay competitive.

Diversification and Reshoring

Companies look for aluminum from countries with lower or no tariffs. This reduces costs. At the same time, many bring production back to the U.S. They build or expand local plants. This move avoids tariffs and cuts dependence on imports.

Technology and Contract Changes

Companies use new extrusion methods and increase automation to lower costs. They also adjust contracts to handle price swings. Price adjustment clauses help manage sudden cost increases. Some firms use hedging to lock in prices and reduce risks.

Overview of Adaptation Strategies

| Strategy Category | Description | Expected Impact |

|---|---|---|

| Supplier Diversification | Sourcing from countries with lower or no U.S. tariffs. | Reduced import costs, broader supply base. |

| Reshoring Production | Shifting manufacturing operations back to the U.S. | Elimination of import tariffs, increased domestic control. |

| Technological Innovation | Investing in advanced extrusion processes and automation. | Lower production costs, enhanced competitiveness, improved product quality. |

| Contractual Adjustments | Implementing price clauses and hedging strategies in supply agreements. | Mitigation of price volatility risks, more predictable costs. |

| Increased Recycling | Utilizing tariff-exempt scrap aluminum more extensively. | Cost savings, environmental benefits, reduced reliance on primary imports. |

This table summarizes the core strategies adopted by players in the aluminum extrusion market to adapt to the new U.S. tariff environment in 2025. These approaches focus on cost reduction, supply chain resilience, and leveraging domestic or tariff-advantaged resources.

Future Outlook: Steering Through the New Tariff Era

U.S. tariffs will keep domestic aluminum production high and change global trade permanently. Countries relying on imports may face higher prices or supply shortages. This will lead to new investment in aluminum extraction and processing outside traditional areas.

Demand for lightweight materials in cars, buildings, and planes will keep growing. But manufacturers must handle extra costs and market changes.

Tariff policies may keep shifting, making the market unstable and divided. Companies that manage supply chains well, invest in efficient technology, and use options like recycling will have an advantage. Staying flexible and planning will be vital.

The path forward requires quick decisions, clear plans, and careful watch of economic and political trends. Like steering a ship through rough seas, success demands a steady hand and sharp focus on what lies ahead.

This video clearly explains the U.S. decision to raise tariffs on steel and aluminum to 50% in 2025. It outlines the main reason: to support the American steel industry. The video also shares concerns from other sectors that rely on these materials. This clip is relevant because it covers the key policy change driving shifts in the global aluminum extrusion market. It offers clear insights into why the tariffs increased and how they affect the market right away.

Frequently Asked Questions (FAQ)

The U.S. Section 232 tariffs are duties imposed on aluminum imports under national security grounds. In June 2025, these tariffs were increased from 25% to 50% on a broad range of aluminum products and their derivatives, with few country-specific exceptions.

The 2025 tariffs have led to significant increases in both imported and domestically produced aluminum prices. This has resulted in higher costs for aluminum extrusions, affecting manufacturers and downstream industries, and causing increased market volatility.

While the 50% tariff applies broadly, some countries, like the United Kingdom, have negotiated specific trade agreements that allow for a lower tariff rate, such as 25%. However, these exceptions are limited and subject to ongoing review.

Global supply chains are adapting through strategies like supplier diversification to lower-tariff countries, reshoring production to the U.S., and investing in technological innovations to reduce costs. The tariffs have also inadvertently boosted the domestic recycling of scrap aluminum due to its tariff-exempt status.

The long-term outlook suggests a sustained higher level of domestic production in the U.S. and a permanent reconfiguration of global trade flows. The market is expected to remain fluid and potentially fragmented due to ongoing policy uncertainties, but demand for aluminum extrusions is likely to continue, driven by industrial applications.

Conclusion

The U.S. Section 232 tariffs on aluminum extrusions rose to 50% in 2025 and caused major changes. Costs went up. Supply chains became tangled. Companies had to change their plans fast.

But this shift also brought some good news. Domestic production in the U.S. grew. Recycling scrap aluminum surged too. This saves energy and helps reduce costs.

To succeed, businesses must stay flexible. They need smart sourcing, better production methods, and careful attention to global politics. The market’s future depends on how well companies adapt to these changes.